I.P. schools announce 15-16 tax levy

Island Park schools announced the proposed tax levy — $31.8 million — for the 2015-2016 school budget at the Board of Education meeting on Feb. 23. This is an increase of $472,001, or 1.50 percent. This is up from a $421,741 increase last year.

The proposed budget of $38.9 million is a $649,621, or 1.69 percent, increase from the current year’s budget.

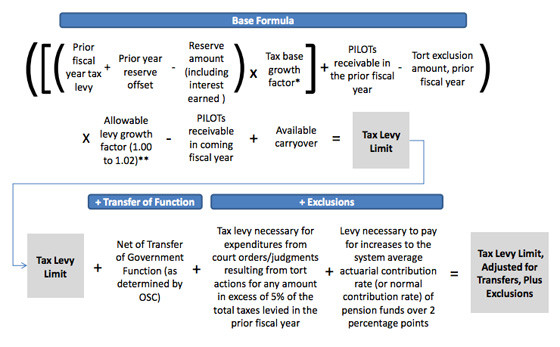

Under a 2011 law, the tax levy cannot be higher than a number determined by a formula. Part of this formula includes the Consumer Price Index (CPI), which measures inflation. The CPI is 1.62 percent for the 2015-2016 school year. The year before that, it was 1.46 percent. No matter what, the CPI is capped at two percent.

Marie Donnelly, the district School Business Official, gave a presentation on how the tax levy was determined for the district. It starts with last year’s tax levy and money in reserves, multiplied by the CPI, minus Payments In Lieu of Taxes (PILOT). Certain items, such as bond debt, construction costs and retirement payments, are exempt from the tax levy limit.

A levy over the tax cap can only be passed through a supermajority, or 60 percent of the vote. “I haven’t seen it done very often,” said Donnelly. “Most districts do try to stay within that cap.”

Under the formula, the school district could increase the tax levy by $828,408, or a 2.64 percent increase. “We reviewed our budget with our administration, looking at the needs for next year,” said Donnelly. “And we believe based on what we’ve looked at that the increase to our taxpayers would be about 1.5 percent of [last year’s tax levy], which equates to $472,001.”

The school district will be dipping into money left over — about $3.2 million — to cover this year’s budget. “It’s money out of fund balance which would be money left over from either revenues in excess of what was anticipated, or under-expenditures,” said Al Chase, the former interim School Business Official. “That’s primarily where the money will come from. And then beyond that, there will be some money coming out of reserve funds.”

Chase and Superintendent Rosmarie Bovino explained that the district has money left over because they assume the most of expenses and the least of revenues. “And districts are finding themselves in a situation now, because of this tax cap, that they have to use those moneys,” said Chase. “That they have to pull those monies out to keep the tax rate, the rate of tax increase low.”

The district receives $173,082 in PILOT from Bayview Nursing and Rehabilitation Center. Under this agreement, the yearly payment will increase to $198,817 by 2026. “We know we would have collected much more than that,” if Bayview paid regular taxes, Bovino said. “It’s fixed, that’s the problem with the PILOTs.”

The next meeting is on March 9 at 7:30 p.m. at the Conference Center. Anticipated revenues will be discussed. The school budget vote is on May 19.