I.P. residents, LIPA officials weigh in on tax cert case

Laura Hassett has lived in Island Park her entire life. But for the past two months, the mother of three boys has resided in a rental home in Atlantic Beach with her husband and 81-year-old mother. Faced with flood insurance rates that she was told could rise to $9,000 a year, Hassett said she had no choice but to raise her home.

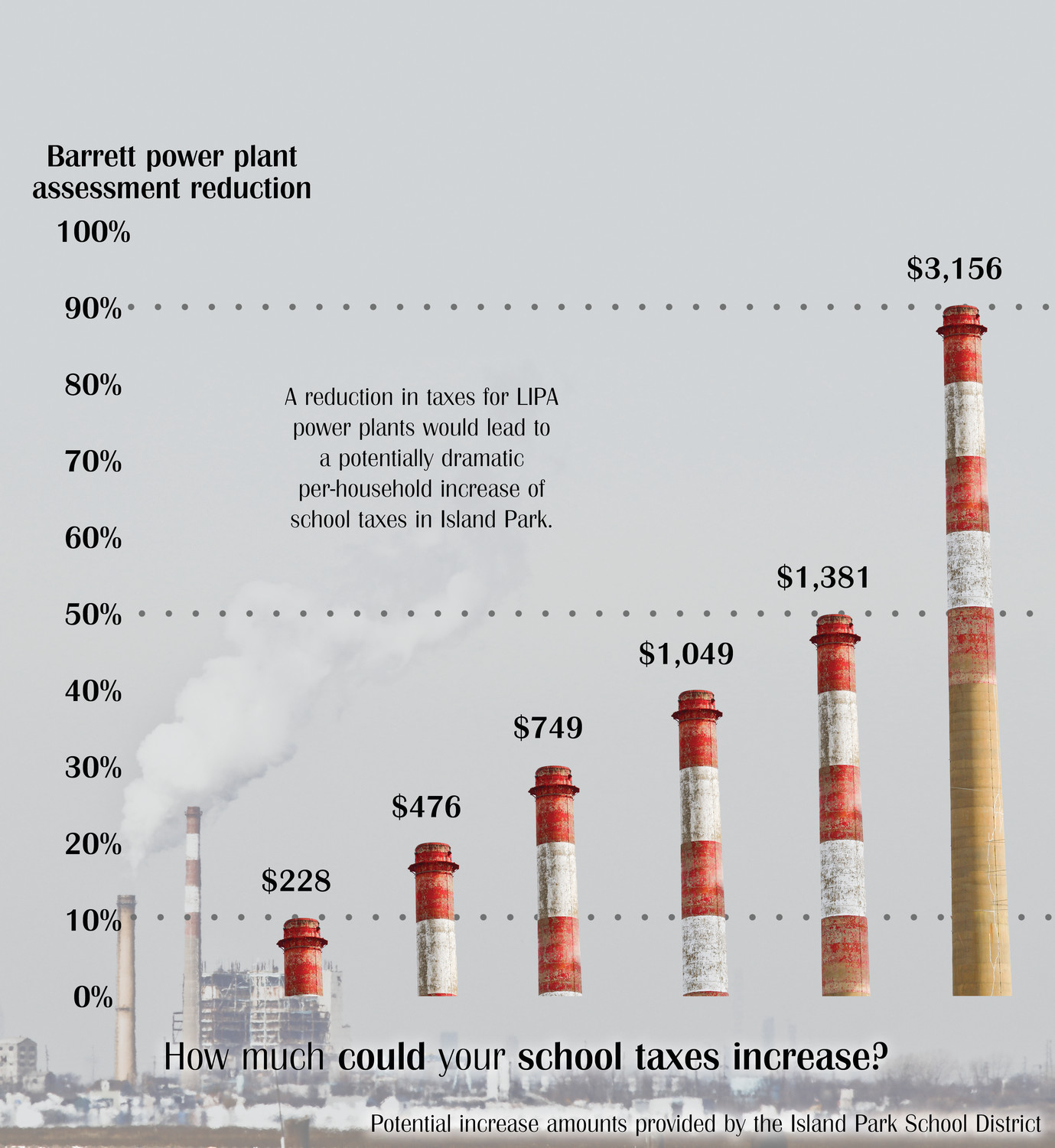

As a two-income family, Hassett said, “We work hard for our money.” But in addition to the skyrocketing price of flood insurance and the costs of raising, she said she pays around $7,000 per year on her school tax bills — a number likely to go up as the Long Island Power Authority seeks to aggrieve its property taxes on the E.F. Barrett power plant in Island Park by up to 90 percent. Roughly 40 percent of the school district budget is comprised of those taxes.

School officials have estimated that if LIPA were to receive the full reduction it is seeking, school taxes could increase by as much as $3,000 per household, and as a mother who sends her eldest two sons to Catholic school, Hassett said, “I don’t like getting nothing for my money.”

Echoing her concerns, Nick DeMatteo who has lived in Island Park since 1947, said he wondered how much taxes would rise. “I’m paying village tax, I’m paying county tax, I’m paying school tax,” he said. “If this keeps going up, how much more do they expect us to pay? It isn’t fair to pay all these taxes and get nothing for it.”

The Island Park School District has been fighting the grievance proceedings, seeking to block them. At a March meeting, the district’s attorney, Bob Cohen, told residents its chances are 50-50 at this point.

Speaking by phone, LIPA Chief Executive Officer Thomas Falcone argued that the utility had no choice but to challenge the assessments on the facilities.

“These plants are very, very clearly over-assessed,” he said, and to illustrate the point added that the property taxes on the Indian Point nuclear power plant in upstate Buchanan, which produces enough electricity to power all of Long Island, equal around $32 million a year. By comparison, property taxes on Barrett, which operates 44 percent of the time and produces a fraction of that amount, currently amounts to $42.6 million a year.

Falcone said it was unfair to the rest of LIPA’s 1.1 million customers, who he argued are paying for taxes on the overassessed plants through their electric bills. “The issue is that you’re not paying for your own local services,” he said. “You’re paying for someone else’s.”

While Falcone acknowledged that most LIPA customers would see decreases of a few dollars in their electric bills, he argued the money his company would save through the grievance effort would help suppress rate increases in the future.

Though he expressed confidence that LIPA would recieve the 90 percent reduction it seeks, a settlement, Falcone said, is still on the table. LIPA is offering to reduce Barrett’s value by 50 percent to be phased in over nine years, as well as waive more than $285 million in tax refunds that would be owed by Nassau County. It is the same offer, he said, that is on the table for the other taxing districts with plants for which his company is challenging the taxes.

“We’ll still offer them a really, really good deal,” Falcone said. “Just not as good as they had.” But he warned that should Nassau County or the school district not take the settlement, the 90 percent reduction, he said, is “going to be the likely outcome.”

“It’s unpleasant,” he said of the situation, but should the parties agree to the settlement, “it’s going from among the lowest school taxes on Long Island to among the lowest on Long Island, just not as low.”

Hassett, however, said that the relatively low school taxes are a selling point in a kindergarten-to-eighth grade school district that lacks a high school. “One of the things that draws people here is the low taxes,” she said. “Not only is [LIPA] hurting people, they’re hurting their investment.”

Lawmakers step in

Anticipating at least some degree of tax increases within the communities hosting the plants, State Senate Majority Leader John Flanagan (R-Smithtown) introduced a bill, co-sponsored by Sen. Todd Kaminsky (D-Long Beach), that is intended to soften the blow for school districts facing potentially drastic losses to their tax bases.

Bill S8235 would allow the creation of tax stabilization reserve funds to lessen the hit to affected communities, as well as broaden the use of an existing $30 million power plant cessation mitigation fund set up by the state. Additionally, the bill would extend the time for the tax payments on LIPA plants to ramp down to 15 years.

While Kaminsky said he would push for the bill, he urged the parties involved to consider a settlement.

“There’s no doubt that it’s a very difficult position for the county and village,” he said by phone. “On the one hand, the settlements should probably be more generous. Losing 40 percent even over time is going to be difficult.

“On the other hand,” he continued. “Losing a court case would be catastrophic. A settlement is obviously something that should be considered.”

Legislator Denise Ford (R-Long Beach) said she would support any effort to provide tax relief for the affected communities, adding that she hopes the Senate bill passes.

For Hassett, however, the presence of the plant so close to her home is enough of a burden. “I think [LIPA] has a lot of nerve for seeking this out.”

She said she was concerned not just for her own family, but also for older residents in the community. “If people with two incomes are going to struggle, what’s going to happen to the senior citizens and those living on fixed incomes?” she said. “Those are the people I’m worried about.”

47.0°,

Mostly Cloudy

47.0°,

Mostly Cloudy