Legislators push to repeal MTA tax

Long Island employers got a bit of good news earlier this month when the State Senate passed a bill to repeal the Metropolitan Transit Authority’s payroll tax — shortly after the MTA terminated its contract to operate Long Island Bus and reduced services throughout the Long Island Rail Road system.

Sen. Charles Fuschillo (R-Merrick), chairman of the Senate’s Transportation Committee, was among the cosponsors of legislation that would gradually phase out the Metropolitan Commuter Transportation Mobility Tax, which was enacted in 2009 and is assessed on all jobs in the public, private and nonprofit sectors, including schools, local governments and charities. Nassau County government alone spends about $3 million annually on payroll taxes. The legislation also calls for a forensic audit of the MTA.

“Repealing the MTA payroll tax is essential to getting Long Island back on the right track for economic prosperity,” Fuschillo said shortly after the bill passed on June 15. “The payroll tax … has devastated businesses, municipalities, nonprofits and schools.”

Assemblyman Ed Ra (R-Franklin Square) made a push for his fellow Assembly members to follow suit and join the Senate in approving the legislation. “The MTA has been using the taxpayers of New York like we’re an ATM,” the freshman Assemblyman said. “With 800,000 New Yorkers unemployed, we should be doing all we can to create jobs and lower taxes. Our schools and small businesses are forced to pay this tax while at the same time morning trains are being reduced and weekend services eliminated at several stations. The MTA payroll tax only allows a bloated bureaucracy to continue to fund its inefficient services with our money as it eliminates services from our community.”

The MTA declined to comment.

If approved by the Assembly, the bill would repeal the tax — 0.34 percent of total payroll expense for employers — on Long Island and in Westchester County and other suburban areas outside New York City. But rumor has it that Assembly Speaker Sheldon Silver has blocked the legislation. Although the MTA operates primarily in the five boroughs and offers limited services elsewhere, it collects revenue from counties outside the city in the form of taxes and fees added to payrolls, gasoline and fuel oil, mortgages, sales tax and Department of Motor Vehicle transactions. The $1.4 billion payroll tax was adopted as part of a bailout package for the MTA.

“This MTA tax kind of threw us because we don’t even use the system,” said Paulette, a Baldwin resident whose husband works from home as an independent contractor. She declined to give her last name. “I think they just said, ‘This is a good way to get some extra money.’ … We don’t take the bus, we don’t take the train. We have to pay taxes, but this one seems grossly unfair.”

State Sen. Kemp Hannon (R-Garden City) described having similar feelings when he voted against the $2.2 billion MTA bailout plan and what he called the “egregious” payroll tax in 2009. “I said repeatedly this was an unjust attempt to drive up costs for commuters while doing nothing to reform the wasteful spending of the MTA,” Hannon said. “I find this tax to be completely unacceptable.”

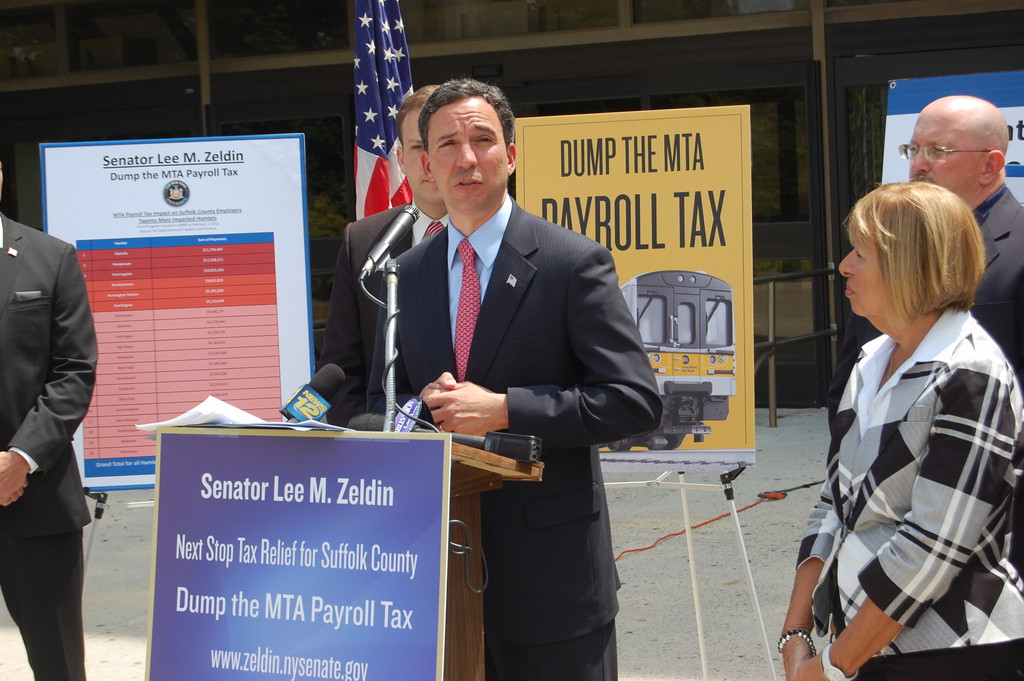

Sen. Jack Martins (R-Mineola) outlined a plan to phase out the payroll tax. He, along with Sen. Lee Zeldin (R,C,I-Shirley), developed the legislation so that it would take effect in 2012 by exempting small businesses with 25 or fewer employees, as well as public and non-public schools, and reducing the payroll tax for Nassau and Suffolk counties gradually, until Jan. 1, 2014 — when the tax would end entirely, under the Martins-Zeldin plan.

“The elimination of this tax, which should never have been implemented, will save our taxpayers millions of dollars. It has created a hardship for our businesses, schools, nonprofits, hospitals and municipalities during an already difficult economic time,” Martins said.

Repealing the tax, Martins said, will boost the local economy. The estimated savings from the elimination of the MTA Payroll Tax would be $767 million, he added. He called on Silver and Gov. Andrew Cuomo to get on board with the Senate.

“This tax was unfair to begin with and should never have been instituted,” said Anne Stampfel, who owns the Malverne Cinema and Bellmore Movies with her husband. “It’s taking way too long to repeal it. Before a company of the magnitude of the MTA was given specialized tax money, the company itself should have been put under the microscope to ensure that everything that could have been done [was] done.”

In addition to criticizing the legislators who approved the tax in 2009, Stampfel faulted the MTA for its poor management. “If we all ran our businesses like they do, it would be an economic meltdown,” she said. “Shame on the top-heavy management.”

Jackie Nash contributed to this story. Questions about this story? JNash@liherald.com or (516) 569-4000, ext. 214.