I.P. school taxes and budget decrease

Superintendent says programs will stay intact

Island Park schools will see a reduction in the budget but not a reduction in programs, according to administrators.

The school district announced its $38.78 million budget — a $120,000 decrease from the current year — at a Board of Education meeting on Feb. 22. This is due in part to a reduction to the proposed $31.82 million tax levy — which is a $56,000 reduction.

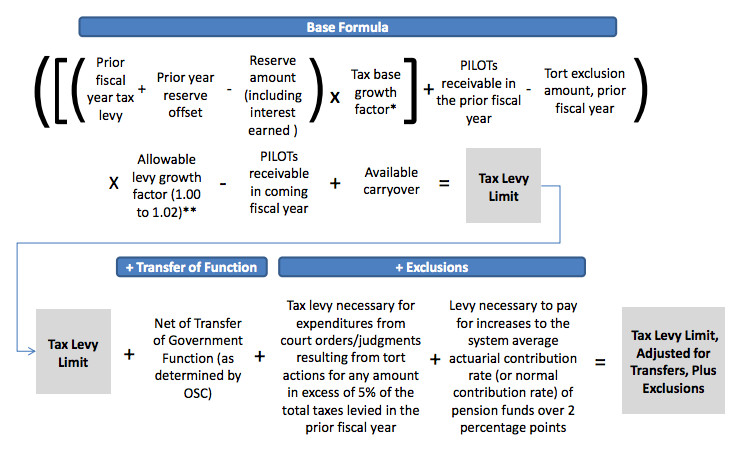

Since 2012, the state tax cap has limited municipal tax increases to approximately 2 percent or the rate of inflation, whichever is lower. Factors such as existing debt and Payments in Lieu of Taxes also help determine the cap. In Island Park’s case the district had a smaller exclusion within the formula because it has paid off some debts. As a result, the allowable tax levy limit is .18 percent smaller.

“Our debt service dropped,” said School Business Official Marie Donnelly. “Which is a good thing as far as we’re paying off our debt, but the debt service… was one of the those exclusions that you can take out as part of the calculations. It helps you actually when you have debt.”

Districts can exceed the cap, but those that do need a supermajority of at least 60 percent of voters to approve their budgets.

Superintendent Rosmarie Bovino said that the district would not try to pierce its tax cap. She said that the reduction is covered by a decrease in retirement costs and paying off debts, so there will not be cuts. “The decrease in debt as well as the decrease in costs (such as [retirement costs]) enables us to keep all programs intact and remain in compliance with the tax cap levy limit,” she wrote in an email. “We do not foresee the need to try to pierce the cap. We are also very sensitive to our community’s financial limitations as they continue to recover from the economic recession, which was exacerbated by Sandy.”

The district did not disclose the amount by which taxes would increase for the average homeowner because the data needed to make those calculations has not been received from the Nassau County Assessor’s Office.

The slideshow presented at the budget meeting can be seen on the district’s website under the “BOE” and “Budget Info” tabs. It is labeled “Proposed Budget 2016-2017 An Explanation of the NYS Tax Cap”. The next meeting, which is scheduled for March 21 at 7:30 p.m. at the Conference Center across from Hegarty School, will detail the anticipated expenses of the district.

Residents will vote on the budget on May 17.

63.0°,

Partly Cloudy

63.0°,

Partly Cloudy