Hundreds of Long Beach homes need to be rebuilt

City says that homeowners can appeal damage assessments

Fred Vordermeier, 39, who moved to Long Beach from Manhattan with his wife in 2009 to raise a family, pays $3,600 a year for flood insurance. He said that the foundation of his East Chester Street home shifted and cracked during Hurricane Sandy, but his insurance company won’t cover the damage.

“We thought Long Beach would be an ideal place to raise a child until this happened,” said Vordermeier, who is now living in Long Island City with his wife and their 3-year-old daughter. “Our insurer said that it was the soil movement that caused the damage and not floodwater, so therefore the damage wasn’t covered. I can’t make any more repairs before the foundation is repaired; there’s no structural integrity.”

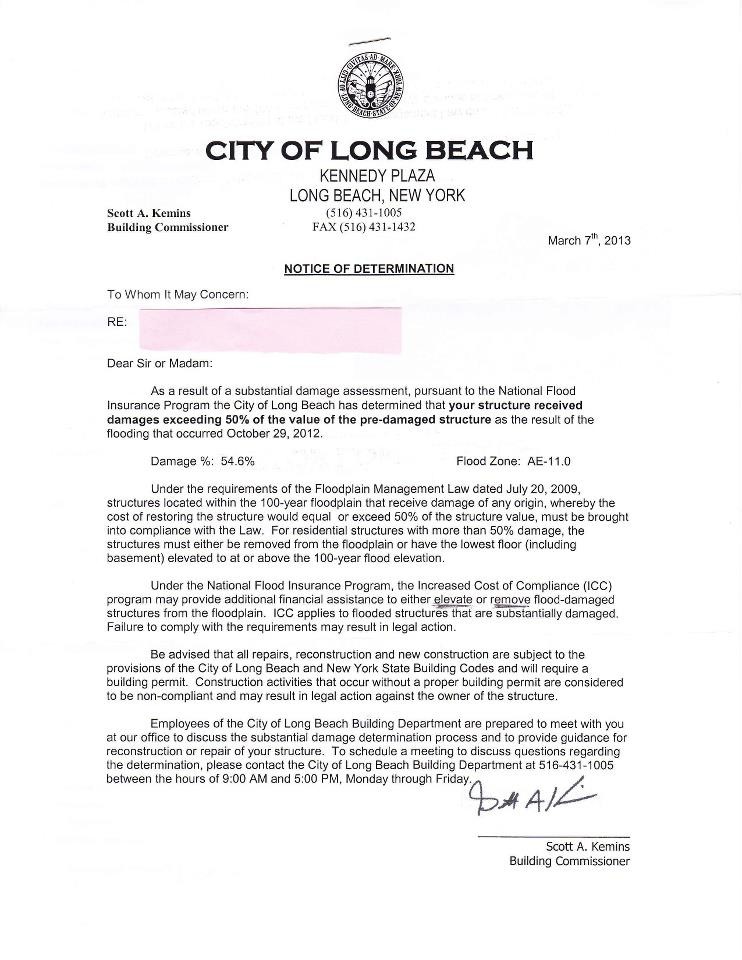

Although Vordermeier’s is not one of them, approximately 865 homes in Long Beach may have to be either elevated or completely rebuilt as a result of the storm, and homeowners who choose not to raise or demolish their homes could end up paying as much as $9,500 a year in flood insurance.

In late January, a team of 10 inspectors from the Federal Emergency Management Agency began assisting the city’s Building Department with its Increased Cost of Compliance inspections, and examined nearly 3,000 homes throughout the city, a process that was completed earlier this month.

New height requirements

FEMA now requires that any new home built in a flood zone meet specific height requirements. FEMA updated flood plain maps for Nassau County in 2009, and designated most of Long Beach a flood zone.

The agency’s National Flood Insurance Program requires that homes with more than 50 percent damage from Sandy be elevated to base flood elevation, which varies throughout the city from 8 to 17 feet above sea level. Any part of a home that is below that elevation cannot be habitable or house things like boilers, heating equipment or washing machines. The new rules, FEMA officials said, are intended to minimize flood losses. The city recently passed measures to increase the height limit of homes to 23 feet to comply with FEMA and New York state building code requirements.

39.0°,

Fair

39.0°,

Fair