Deadline set for reopening FEMA flood claims

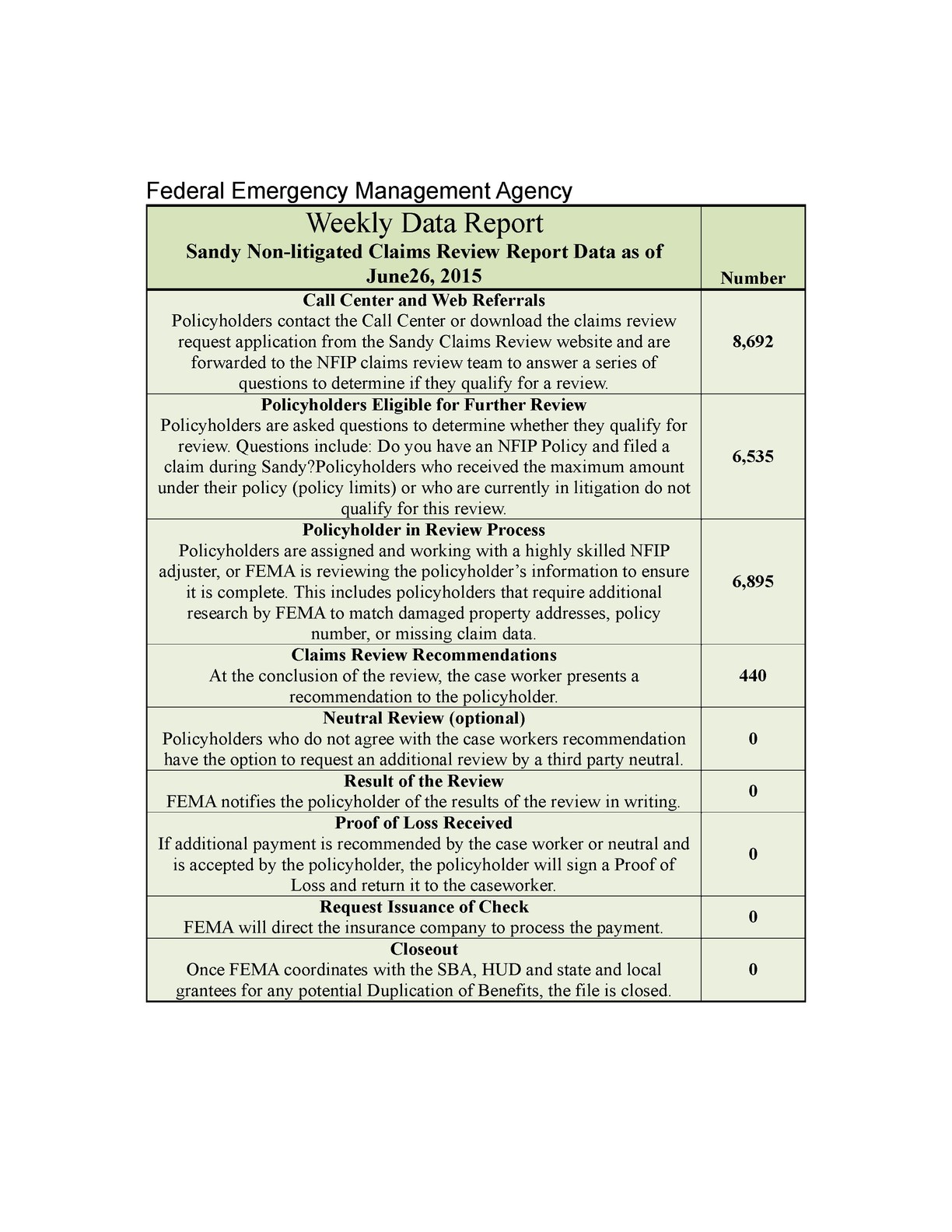

The Federal Emergency Management Agency [FEMA] has set a deadline for requests to review potentially underpaid Hurricane Sandy claims by September 15.

Insurance policyholders can opt-in to the Sandy claims review process either by calling 1-866-337-4262 or visiting www.fema.gov/hurricane-sandy-nfip-claims.

After hearings and communications from four senators, including New York’s Senators Charles Schumer and Kirsten Gillibrand, FEMA agreed to take a second look at as many as 144,000 National Flood Insurance policyholder claims, with an eye toward potential upward adjustments in payouts. Letters to policyholders began going out May 18 asking them to begin the review process.

Many policyholders are skeptical, not wanting to reengage with FEMA, the organization that oversaw how their flood claims were handled in the first place.

A report published on June 23, from the U.S. Senate Banking Committee argues that there was no “systematic underpayment” of flood insurance claims in the wake of Sandy, which is the opposite of the experiences and beliefs of many shore homeowners, that might explain the relatively low enrollment in the review process. However the allegations that led to the creation of the Sandy claims review process was not part of the Senate committee’s report.

The review was ordered by FEMA after evidence emerged of an alleged scheme to change the engineering reports that insurance companies use to determine if a structural damage claim is paid out. There are reports that some damage caused by Sandy was classified as happening pre Sandy, by environmental causes, and thus not covered under Sandy flood claims allowing insurance companies to deny claims.

Other policyholders say their insurance company lowballed the prices they would pay for materials and labor to fix homes. Not having enough adjusters in the north east insurance companies brought in people from other states. They prices material and repairs based on what they knew from home, not the cost of materials on Long Island.

Some homeowners have hired lawyers to help them navigate the reopened claim morass, and those lawyers are charging a quarter to a third of what the homeowner gets in legal fees. But not for profits who are helping homeowners, are saying there is no need to hire an attorney, and no reason to pay money needed for repairs to a lawyer.

In addition there is the possibility that a homeowner may have to repay any additional funds received from FEMA to either the Small Business Association [SBA] if they took and SBA loan or to New York Rising if they received help from there. All three programs use federal dollars and under a law called the Stafford Act you cannot be paid twice for the same repair, a practice called duplication of benefits.

39.0°,

Fair

39.0°,

Fair