Is now the time to buy?

Local real estate agents weigh in on the housing market

Real estate experts in Oceanside and Island Park say they are confident about the local housing market, despite some sobering national figures. Late last month, the U.S. Commerce Department reported that sales of new single-family homes had dropped more than 11 percent in January, to a seasonally adjusted rate of 309,000 units sold. According to the Associated Press, that is the lowest recorded level in nearly 50 years.

But Nancy Achstatter, owner of Home and Hearth Real Estate in Oceanside, said that figure does not accurately reflect the local market, since most major construction of new homes on Long Island wrapped up in the mid-1960s.

"Our market is not as much about new home sales as it is about resale," Achstatter explained. Any new houses built in Oceanside and Island Park, she added, are mostly "spot" construction projects.

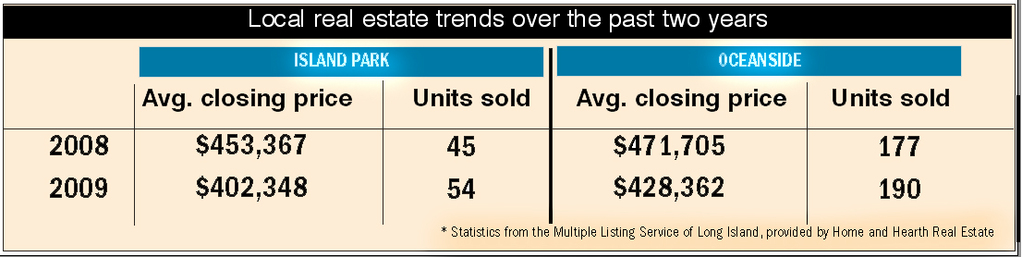

Overall, Achstatter said, the local market has seen more activity recently. From 2008 to 2009, she said, the average number of units sold increased, while the average closing price dropped -- evidence, she believes, that the current market is geared toward first-time home buyers looking for lower entry-level prices.

Mike Scully, owner of Century 21 Scully Realty in Island Park, said there has been more activity because sellers are adjusting their prices in a market that has become more competitive with increased inventory. "There is a lot of activity out there, but the price has to be right," Scully explained. And while that is true of any market, Scully and Achstatter noted several economic factors that have combined to create a prime housing market right now.

The extension and expansion of the federal first-time home buyer tax credit is one of those factors, according to Achstatter. Based on income and other criteria, new home buyers can receive up to $8,000 in tax credits on their first home purchase. The federal government recently extended the program to April 30, and has expanded it to include current homeowners looking to purchase new homes. Those buyers can earn up to $6,500 in tax credits toward their purchase.

64.0°,

Mostly Cloudy

64.0°,

Mostly Cloudy