Hempstead IDA revokes controversial mall tax breaks

UPDATE APRIL 27 AT 12:45 P.M.

The Hempstead Town Industrial Development Agency will decide on Thursday whether to revoke Green Acres Mall tax breaks that took effect in October, according to a meeting agenda on its website.

The news comes after months of public outcry and efforts by local lawmakers to address a property-tax hike that many have attributed to tax incentives granted to the mall by the IDA in 2015.

IDAs are quasi-governmental agencies that work with business owners or developers to provide financial incentives to enhance local economies. They typically obtain properties in need of development and then lease them back to their owners via payments in lieu of taxes, or PILOTs.

The tax breaks reduced the mall’s tax payments by about $6.5 million last year, and will lower them by a similar amount each year until 2022. Before IDA incentives were granted, the mall’s affected properties paid about $20.6 million in county, school, special district, town and village taxes. (A small section of the mall along Sunrise Highway is in the village.) With the switch to the IDA’s payment schedule late last year, that total dropped to $14.1 million. The tax revenue that the mall contributes to the impacted municipalities might not return to pre-IDA levels until 2031, unless the tax breaks are revoked.

PILOT contracts are common in New York, and are designed to ease the financial burden of commercial development. IDAs, are, however, generally prohibited from giving tax breaks to retail projects. The Green Acres Mall was given a tourist exemption because at least 51 percent of its shoppers come from outside Nassau County.

When tax bills in school districts 13, 24 and 30 increased, on average, between $322 and $758 in October, residents were furious that the mall had received such a sizable tax reduction. A report from the state comptroller’s office last month declared it the state’s second-largest tax break of 2015.

What caused the tax hikes?

There are, however, other factors that could have contributed to the increases that residents saw last year. When properties enter PILOT agreements, the payments are no longer considered tax revenue — which changes the way the county assessor calculates tax burden distribution. That shortage had to be made up by taxpayers in other property classes, namely, single-family homes, apartments and condominiums, and utility company properties. In the case of the Green Acres Mall, given the size of the size and value of the property, the shift to non-taxable property was both significant and sudden.

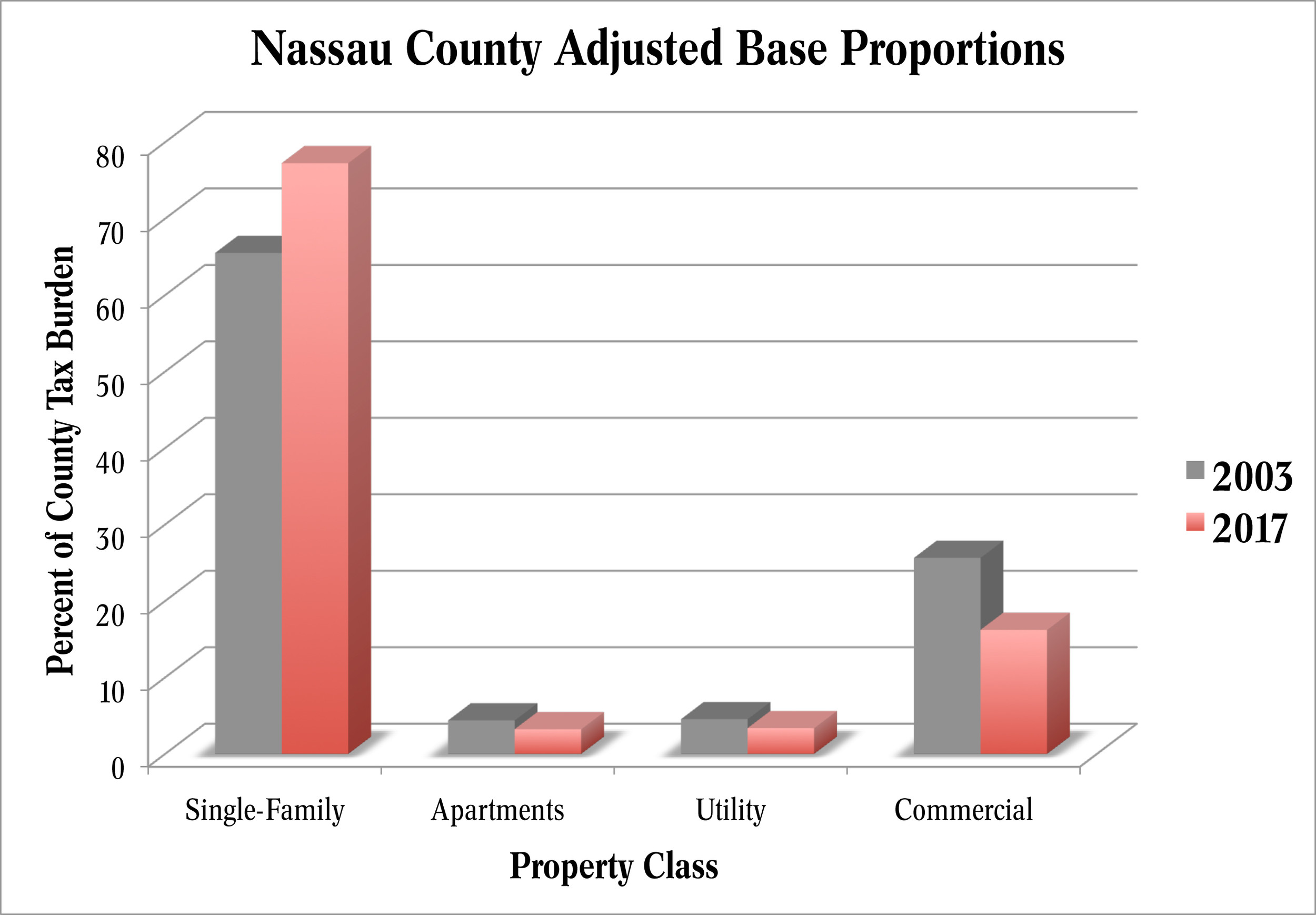

The Nassau County Office of Legislative Budget Review released a report in November discussing the impact of the Green Acres deal that noted that the tax-burden shift to single-family homeowners is happening throughout the county. For example, the report stated that in 2003, single-family homeowners paid 65 percent of the overall county tax burden, and commercial properties paid 26 percent. By 2017, single-family properties accounted for 77 percent of the overall tax burden, and commercial properties, 16 percent.

In addition to the county’s assessment formula, School District 30 has been blamed for causing unforeseen tax increases for residents. A report commissioned by the IDA claimed the district underestimated the PILOT revenue it would receive and levied too much from local taxpayers. School officials claimed the IDA never sent them the necessary details of the new payment schedule. The state comptroller is now auditing both the IDA and District 30.

The impact of the Green Acres Mall PILOT was also likely inflated by the way the Central High School District is funded. Each elementary district must pay a portion of the high school district’s budget, based on the taxable property in that elementary district. Because the mall came off the tax rolls, District 30’s payment to the Central High School District shrank, and that shortage was redistributed across District 13’s and District 24’s properties — similar to the way the tax burden of commercial properties was shifted to single-family homeowners and others to account for the mall’s removal from the tax rolls.

What lies ahead

District 30 officials said that any excess money received as a result of their underestimate would be used to lower next year’s tax levy — which is 15 percent smaller than this year’s.

After Hempstead Town Supervisor Anthony Santino appointed new IDA board members in November, they collected testimony from residents to inform their decision on whether to revoke the PILOT agreement with Green Acres. Officials have said that doing so would certainly subject the board to a lawsuit.

Thomas Levin, an attorney who specializes in municipal law and land use, told the Herald in November that as a general rule, once an agreement is signed, it’s a “done deal,” and the IDA cannot withdraw from it without the other party’s consent.

Levin said that aggrieved parties (other than the general public) could challenge the agreement in court, claiming that the IDA acted illegally or beyond the scope of its authority, or that it failed to give those who want to challenge the agreement sufficient notice. Additionally, he said that the IDA could sue the mall if officials believed that information was misrepresented in the PILOT application. If the decision stands, however, Levin said, there are no obvious options to make taxpayers whole.

In addition to the Hempstead IDA board meeting, scheduled for 9 a.m. in the Town Hall Pavilion at One Washington St. in Hempstead, District 24 officials requested a joint-boards meeting to discuss what they perceive to be an inequitable share of the tax burden.

“We wanted to have a joint-boards to express our feelings that District 24 is paying more than its fair share because of the PILOT,” said Superintendent Ed Fale, “and that District 24 residents and business owners are being over-taxed.”

That meeting is scheduled for Thursday, May 4, at 6:30 p.m. Joint-boards meetings are typically called to discuss items of mutual interest among school boards, Fale said, though there is no official procedure stipulated in state education law for holding one.

49.0°,

Fair

49.0°,

Fair