Keyword: assessments

114 results total, viewing 41 - 50

|

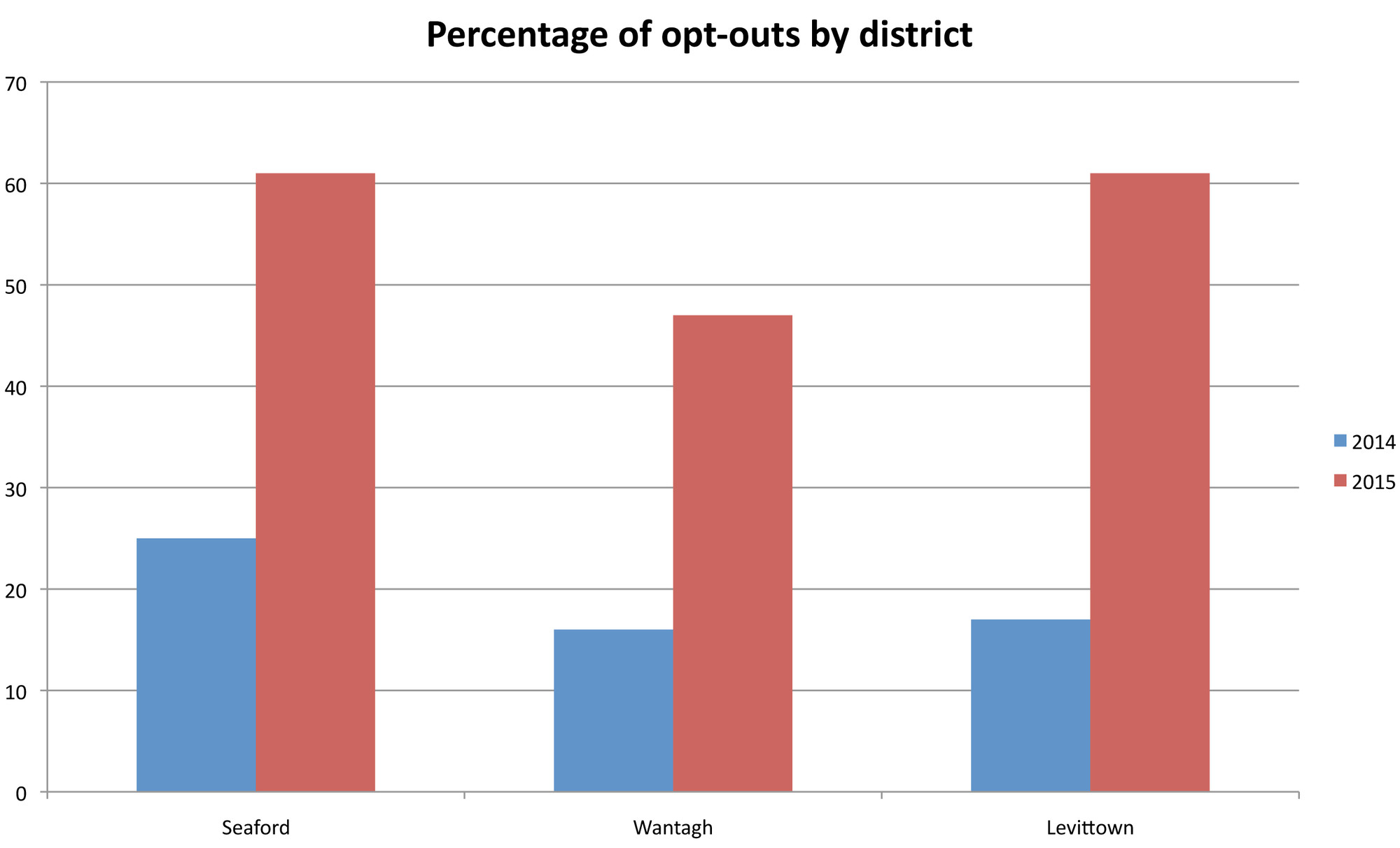

The number of students refusing the New York state assessments increased dramatically this year in Wantagh, Seaford and Levittown, as the movement by parents against high-stakes testing continues to grow.

more

By Andrew Hackmack

|

4/21/15

|

|

Over the years, I’ve investigated many hot-button topics in education, but none is as contentious as the battle over high-stakes testing for students in grades 3 through 8.

more

4/16/15

|

|

On March 31, a crowd of roughly 150 people, mostly parents and teachers in Bellmore and Merrick, packed the auditorium at Brookside School in North Merrick for a forum on the state’s education policies.

more

By Brian Racow

|

4/9/15

|

|

The controversial state standardized testing program begins next week, and hundreds, if not thousands, of local parents are expected to instruct their children to refuse the tests, a decision that has come to be known as opting out.

more

By Andrew Hackmack

|

4/9/15

|

|

Bellmore-based Pride for Youth, a leader in HIV prevention on Long Island since 1993, has launched a ground-breaking PrEP Assessment and Monitoring Program for young gay and bisexual (trans-inclusive) men, through age 30. Supported by a grant from the New York State Department of Health, the program is the first of its kind on Long Island.

more

3/25/15

|

|

Dave Denenberg, the former Nassau County legislator from Merrick who resigned on Jan. 21, the same day he pleaded guilty to mail fraud in connection with swindling a law client of $2.3 million, co-founded a business two weeks later to advise clients about how to reduce their property taxes. It is called Cobra Consulting Group, LLC.

more

By Brian Racow

|

3/13/15

|

|

A homeowner or business property owner receives their tax bill and thinks the amount of property taxes they are paying is too high and does not reflect the value of their properties.

more

By Jeff Bessen

|

2/4/15

|

|

Q: I understand that Nassau County determines taxes in some part by lot size and structural square footage, but is there a standard calculation? I'm in the process of …

more

By Richard G. Fromewick

|

1/26/15

|

|

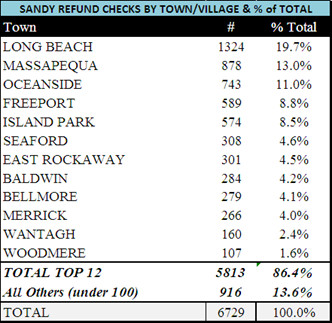

Nassau County Comptroller George Maragos said that 6,700 refund checks, 107 of them to homeowners and businesses in Woodmere, will be mailed, beginning on Dec. 23 through early next month to compensate homeowners whose tax assessments were not reduced for the tax years 2012-2013 and 2013-2014 to reflect the damage incurred from Hurricane Sandy.

more

By Jeff Bessen

|

12/23/14

|

|

Q: My school tax bill that I just received (October 1, 2014) is higher than ever even though I was granted an assessment reduction last year. Why?

A: The school budget …

more

By Richard G. Fromewick

|

10/9/14

|

Currently viewing stories posted within the past year.

For all older stories, please use our advanced search.

For all older stories, please use our advanced search.

65.0°,

Partly Cloudy

65.0°,

Partly Cloudy