Hannon calls for repeal of MTA payroll tax

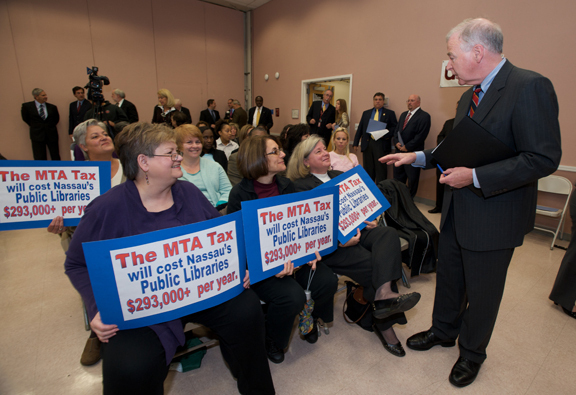

Senator Kemp Hannon, a Republican from Garden City who represents the 6th District (includes East Meadow and Salisbury) and members of the Long Island Senate Delegation today joined business owners and directors of non-profit organizations at United Cerebral Palsy Association of Nassau County to call for the repeal of the MTA payroll tax.

"It’s an outrage that taxpayers are expected to carry this heavy burden on their backs in order to bailout the MTA,” Hannon said. “It’s especially crucial during this tough economic climate that we seek to create jobs and achieve new ways to increase taxpayer savings, but what does Albany do instead? It levies another tax that will force businesses to eliminate jobs and take more money out of the hands of hard working New Yorkers.”

Come November 2nd, thousands of businesses, the self-employed, non-profits and school districts will begin paying part of a $1.5 billion bailout of the Metropolitan Transportation Authority (MTA) through a new tax that will cost them $0.34 per $100.00 of their payroll retroactive to March 1, 2009.

According to the NYS Comptroller’s Office, the impact of the MTA payroll tax on businesses and non-profits in Nassau is $103.9 million and in Suffolk is $87.9 million. The twelve county region surrounding New York City is required to pay the tax.

Bob McGuire, Executive Director of the United Cerebral Palsy Association of Nassau County, safely estimates that the MTA payroll tax will cost his non-profit $100,000. “In a time where the economy is putting such tremendous stress on all aspects of our lives, placing this added burden on non-profits is devastating,” said McGuire.