Glen Cove passes $63.5 million budget

The Glen Cove City Council unanimously voted to pass the city’s 2024 budget of $63.5 million on Tuesday night, the final session before the Nov. 7 election. The budget decreases the total property tax levy from $33.2 million in the 2023 budget, to $33.1 million in 2024. Last year, the tax levy was $33.3 million.

During the budget presentation on the Oct. 10 council meeting, Mayor Pam Panzenbeck stated the property tax rate for homeowners remains unchanged from the 2023 budget, while the commercial tax levy dipped 5.83 percent.

When the budget was first presented to the council during a pre council meeting on Panzenbeck stressed the plan also included an $884,000 bump in full-time salaries, including for emergency medical services workers, members of the Police Benevolent Association and the city’s union workers. The increase for EMS workers was needed to remain competitive against a Nassau County program that elevated the pay of its EMS academy trainees, stating the salary increase was necessary for the city to continue its ambulance service.

All council members said they were happy residents didn’t see higher taxes, but Councilwoman Marsha Silverman cautioned against using one-shot revenues towards the budget, citing an anticipated $750,000 payment from RXR for building modifications towards new development at their Garvies Point location.

“I think there are discrepancies in this budget, but the way that our cycle works is that this budget will pass anyway, “Silverman said. “I think there are a lot of positives in the budget, but as I say almost every year budgeting should not be a once-a-year exercise.”

“This deficit can increase further due to unaccounted inflation and higher interest rates on debt,” Maragos said. “The primary sources of the deficit are from the administration’s overly optimistic projection of an 84 percent increase in building department revenues from the prior year and a 14 percent decrease in debt expense during rising interest rates.”

Maragos also added the budget contains a small property tax increase of .23 percent in 2024 on top of what he alleges is a previous unannounced property tax increase for homeowners of .54 percent

“In 2023 for a total two-year tax increase to homeowners of .77 percent,” Maragos said. “These property tax increases on homeowners are used to provide tax reductions to commercial properties of 5.11 percent.”

In an email to the Herald, City Controller Mike Piccirillo countered Maragos’ statements, saying an individual homeowner’s property assessment is multiplied by the tax rate, which determines the amount of property taxes paid.

“The tax rate for 2024 is the same as 2023,” Piccirillo wrote. “So if the individual’s property tax assessment is the same in both 2024 and 2023, then the amount of taxes to be paid will remain the same (with) no tax increase.”

Among Maragos’ numerous budget analysis was a finding that there’s less money being budgeted for snow removal, recreation and parks, saying the budget under invests in the quality of life.

According to Piccirillo, the recreation’s budget is lower because there was a transfer of funds to the Youth Bureau Department since programs and resources were consolidated.

Piccirillo also noted the parks department budget reflects a decrease because funds were transferred to roads due to the transfer of an employee who was miscategorized in the incorrect department, and that all DPW departments combined have an increased investment of approximately $300,000 or 3.7 percent.

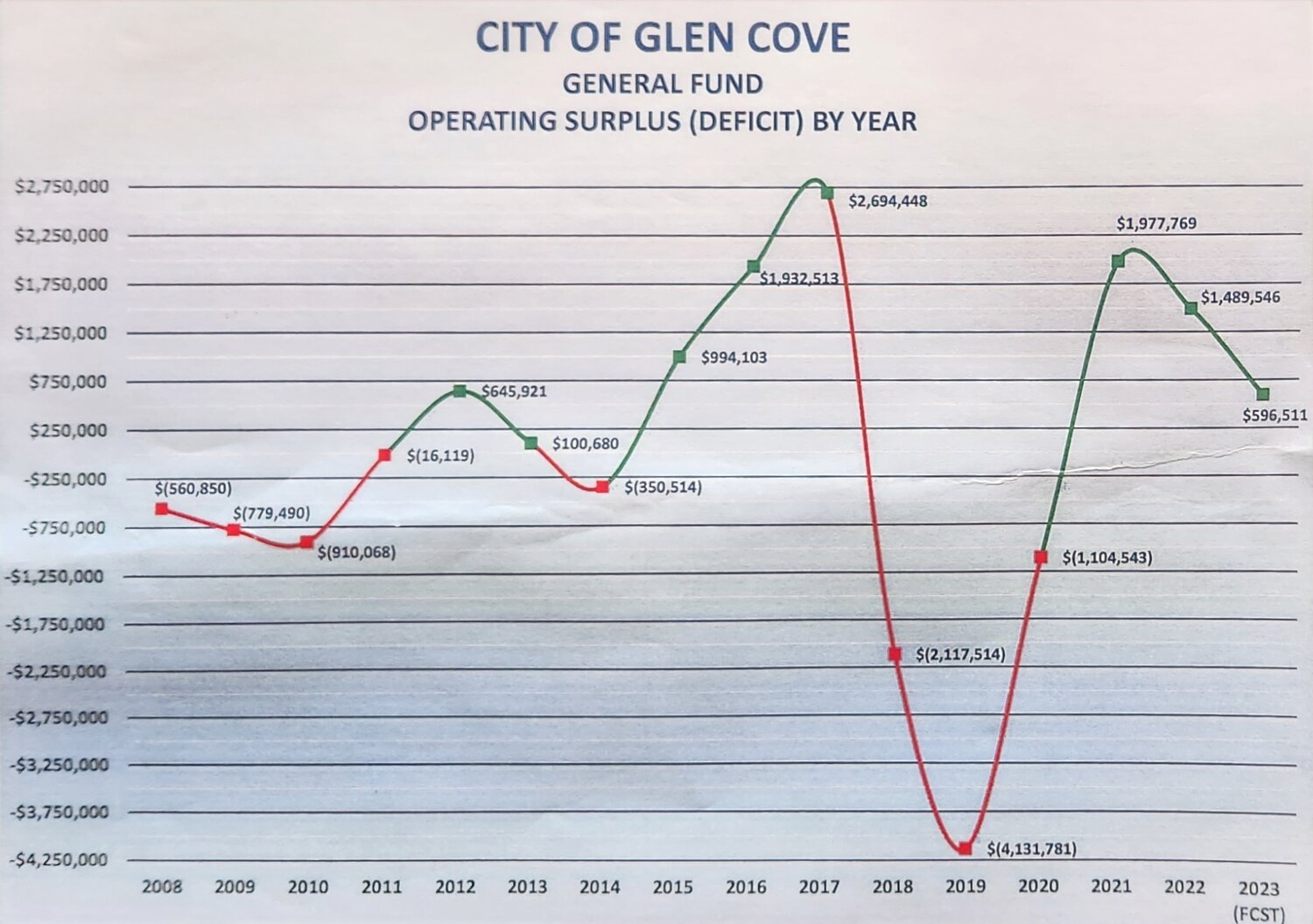

Panzenbeck anticipates the city will likely finish 2023 with an operating surplus of $596,000. If it does, this would mark the third consecutive year Glen Cove maintained a surplus. This surplus could potentially remove the city from state Comptroller Thomas P. DiNapoli’s state-wide report of municipalities facing fiscal stress, which stated the city was susceptible to it. Since last year’s report, the city’s rating decreased 50.4 to 47.1, indicating a trend towards a “no stress” designation.

50.0°,

Mostly Cloudy

50.0°,

Mostly Cloudy